How developers decide what to build on a property is not based on guesswork — it’s driven by zoning laws, traffic patterns, market demand, infrastructure, and financial modeling. While most landowners start with ideas, professional developers start with data and risk analysis.

Zoning Controls Everything — Before Anything Else Matters

Before a single dollar is invested, developers ask one simple question:

“What am I legally allowed to build here?”

Zoning ordinances determine key factors such as:

- Permitted uses (retail, office, multifamily, industrial, mixed-use)

- Height and density limits

- Parking requirements

- Setbacks, buffers, and landscaping standards

- Overlay districts and special conditions

Many owners evaluate what seems possible without understanding what is actually allowed. Without zoning clarity, any development concept is just a sketch on paper.

Learn more about our commercial real estate services for landowners.

For more on zoning classifications, the American Planning Association offers a solid overview.

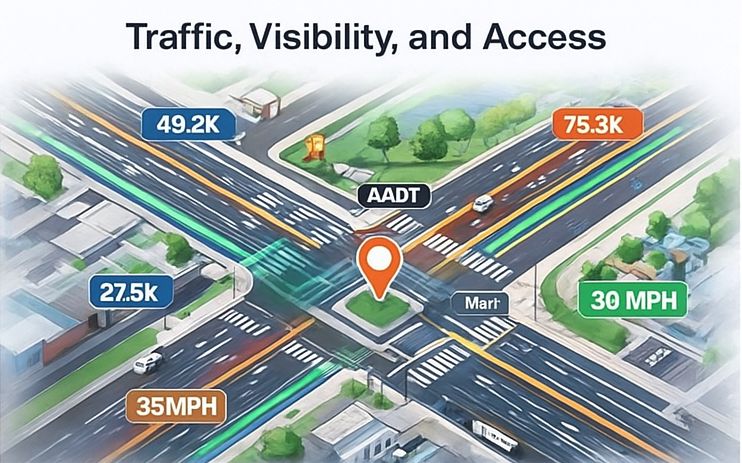

Traffic, Visibility, and Access Define Value

Once zoning is understood, developers look at how the site functions in the real world.

That means traffic patterns, visibility, and access.

Key items they study include:

- Average Annual Daily Traffic (AADT) counts

- Signalized vs. non-signalized intersections

- Ingress and egress (how easily vehicles enter and exit)

- Curb cuts, medians, and turn lanes

- Road speed limits and sight lines

- Whether the parcel is a corner lot or mid-block location

Quick-service restaurants, gas stations, and many retail brands have strict criteria for traffic counts and access.

If drivers can’t easily turn in and out, or if the site isn’t visible at speed, the deal becomes far less attractive — no matter how “good” the land feels to the owner.

Market Demand Determines Use — Not Owner Preference

Landowners often say things like, “This would be a great place for apartments,” or

“I think a shopping center would do well here.”

Developers ask a different question: “What does the market financially support right now?”

To answer that, they dig into market data such as:

- Population growth and household formation

- Income levels and spending power

- Competing properties and pipeline projects

- Historical and projected rent levels

- Absorption trends (how quickly space is being leased or sold)

- Vacancy rates by property type

A site isn’t valuable just because someone imagines it will be.

It becomes valuable when tenants or buyers are willing to pay real money for space there.

According to Federal Reserve Economic Data, demographic and economic indicators directly impact real estate demand.

Infrastructure and Site Constraints Decide Feasibility

Even if zoning, traffic, and demand look favorable, a project can stall out on infrastructure.

Developers spend significant time and money evaluating what it will take to physically serve the site.

That includes items such as:

- Water and sewer availability and capacity

- Utility access (electric, gas, telecom)

- Fire flow and hydrant coverage

- Stormwater management and detention requirements

- Topography, grading needs, and retaining walls

- Soil conditions and geotechnical issues

- Wetlands, floodplain, and environmental contamination

A site with limited or no utilities is not impossible to develop — it is simply more expensive.

And in development, additional cost can kill a deal faster than imagination can save it.

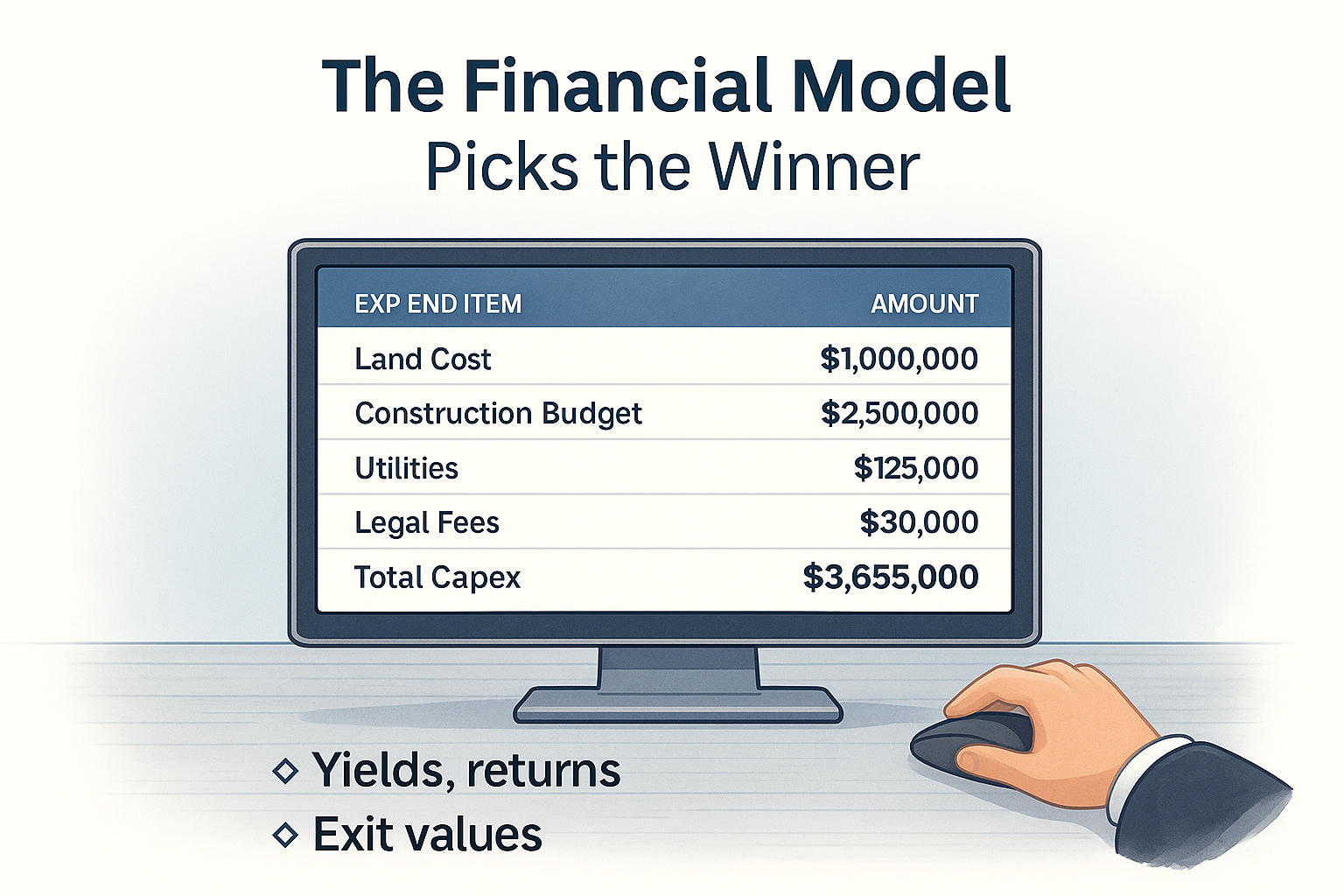

How Developers Decide What to Build on a Property Using Financial Modeling

This is where ideas meet reality. Developers put multiple scenarios into a financial model

to see which one actually creates an acceptable return.

They might compare, for example:

- Retail outparcels vs. inline shop space

- Self-storage vs. multifamily

- Single-tenant build-to-suit vs. multi-tenant center

- Phased mixed-use vs. a single product type

For each scenario, they analyze items like:

- Total development cost and contingency

- Lease-up timeline and stabilization

- Projected rents and operating expenses

- Exit cap rate and potential sale value

- IRR, equity multiple, and yield on cost

If the numbers don’t work on paper, the project will never happen in the real world.

The model, not the owner’s opinion, makes the final call.

Ask about how professional underwriting works in our Highest and Best Use Analysis Guide.

Why Most Owners Guess (and Lose) While Developers Don’t

Most property owners simply don’t have access to all the data and tools that developers use.

They might see a busy road and a growing area, but they don’t see:

- Detailed trade area demographics and psychographics

- Pipeline projects and future competition

- Construction costs and financing terms

- Target return thresholds for different capital sources

Developers, on the other hand, have systems, advisors, and underwriting criteria built around dozens of deals.

They don’t rely on gut feel. They rely on process.

The Real Opportunity Most Owners Miss

The biggest mistake many landowners make is thinking,

“I should build something here.”

A better question is,

“What does this site want to become, based on zoning, demand, and the numbers?”

Sometimes, the smartest move is not to develop the property yourself. Instead, it might make sense to:

- Secure entitlements and sell at a premium

- Enter into a joint venture with an experienced developer

- Structure a long-term ground lease with a credit tenant

- Reposition the site and wait for a stronger market cycle

Understanding your highest and best use is less about guessing a building type,

and more about understanding how developers evaluate your property.

Frequently Asked Questions

How do developers decide what to build?

Developers analyze zoning, traffic, market demand, infrastructure, and financial returns before selecting a property type.

What is highest and best use in real estate?

It is the legally permissible, physically possible, and financially feasible use that produces the highest value.

Should landowners develop or sell?

That depends on zoning, market conditions, access to capital, and risk tolerance. Sometimes selling or partnering creates greater returns.

Want to Know What Your Property Is Really Worth to a Developer?

You don’t have to guess what should be built on your land. We help landowners evaluate sites

the same way professional developers do.

In a site evaluation, we can help you understand:

-

- Which uses are most likely to succeed on your property

- What it would likely cost to bring a project out of the ground

- Which users, tenants, or buyers might be a fit

- Whether it makes more sense to build, partner, or sell

Ask about our development consulting services that help landowners evaluate value before they build.

Understanding how developers decide what to build on a property gives you a major advantage whether you plan to build, partner, or sell.

Ready to see your land through a developer’s eyes?

– Keith Hill